Highlands Ranch, Colorado-based UDR, Inc. (UDR) is a publicly traded apartment real estate investment trust (REIT) that owns, develops, and manages multifamily communities across major U.S. metropolitan markets. Headquartered in Colorado, the company focuses on high-demand, high-barrier-to-entry regions and derives most of its revenue from rental income. Valued at $12.4 billion by market cap, the company owns, operates, and develops apartment communities.

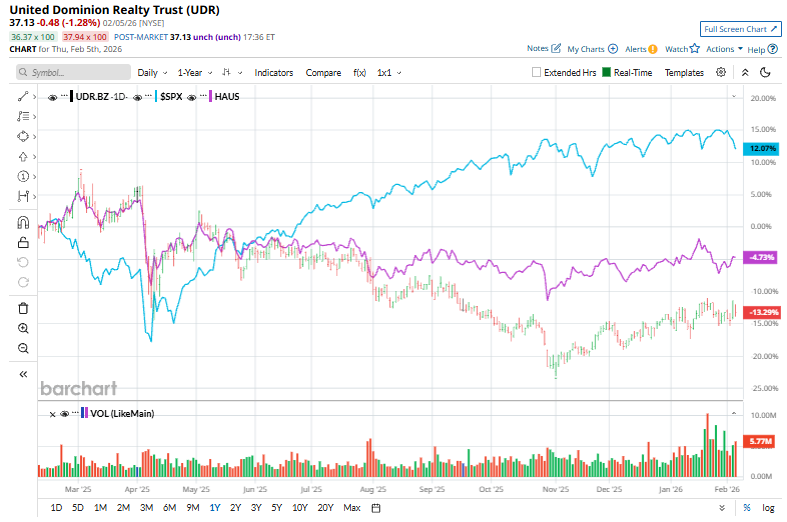

Shares of this leading multifamily REIT have underperformed the broader market considerably over the past year. UDR has declined 12.1% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 12.2%. In 2026, UDR’s stock is up 1.2%, compared to the SPX’s marginal fall on a YTD basis.

Narrowing the focus, UDR has also lagged behind the Residential REIT ETF (HAUS). The exchange-traded fund has declined 5% over the past year. However, the ETF’s marginal loss on a YTD basis lags behind UDR.

UDR has underperformed the broader market over the past year largely due to persistent sector and company-specific headwinds that have pressured investor sentiment. Slowing rental demand and moderating rent growth in several key markets have weakened revenue momentum, while increased new supply has made lease-ups more competitive and slowed occupancy gains.

For FY2025 that ended in December, analysts expect UDR’s FFO per share to grow 2.4% to $2.54 on a diluted basis. The company’s earnings surprise history is impressive. It beat or matched the consensus estimate in each of the last four quarters.

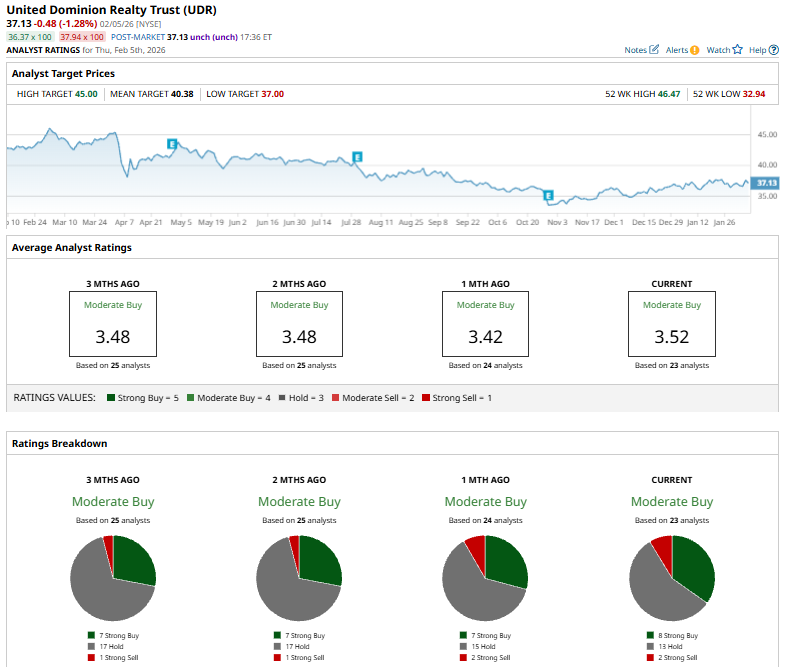

Among the 23 analysts covering UDR stock, the consensus is a “Moderate Buy.” That’s based on eight “Strong Buy” ratings, 13 “Holds,” and two “Strong Sells.”

This configuration is bearish than a month ago, with seven analysts suggesting a “Strong Buy.”

On Jan. 20, 2026, Goldman Sachs analyst Julien Blouin reaffirmed a “Sell” rating on UDR, while raising the stock’s price target from $33 to $37.50, representing a 13.64% increase. The update reflects slightly improved valuation expectations, despite maintaining a cautious outlook on the company’s overall performance.

The mean price target of $40.38 represents a 8.8% premium to UDR’s current price levels. The Street-high price target of $45 suggests an ambitious upside potential of 21.2%.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart